Reading Time : 2 minutesStandard Chartered’s AI Bubble Meter debuts amid frothy valuations, flashing modest upside signals. But is it a genuine risk gauge or a wealth management lure targeting Asia’s elite? Probe the fine print as AI frenzy meets market jitters.

Reading Time : 2 minutesGoldman Sachs is set to spin out its digital assets platform into a standalone company, aiming to enhance blockchain-based financial transactions for large institutions. Led by Mathew McDermott, the initiative seeks to foster collaboration among financial firms and streamline the creation and trading of digital assets, marking a significant step in integrating blockchain technology into mainstream finance.

Reading Time : 2 minutesThe Euro’s creation in 1999 introduced a new era of economic integration in Europe, but it came with the “no-bailout” clause. This rule, designed to ensure fiscal responsibility, prevented Eurozone countries from bailing out one another. However, the 2008 financial crisis tested this principle, leading to emergency financial support despite the clause. The ongoing debate over its relevance continues to shape the Eurozone’s economic policies. Understanding the “no-bailout” clause is key to grasping the complexities of European financial governance.

Reading Time : 2 minutesThe shadow banking system operates outside traditional banking regulations, involving institutions like hedge funds and private equity firms. While these entities play a vital role in providing credit and investment, their lack of regulation contributes to financial instability. During the 2008 crisis, shadow banks were key players in amplifying economic risks. Governments now face the challenge of monitoring this sector without stifling its benefits. Understanding shadow banking is crucial for maintaining financial stability in an ever-evolving economy.

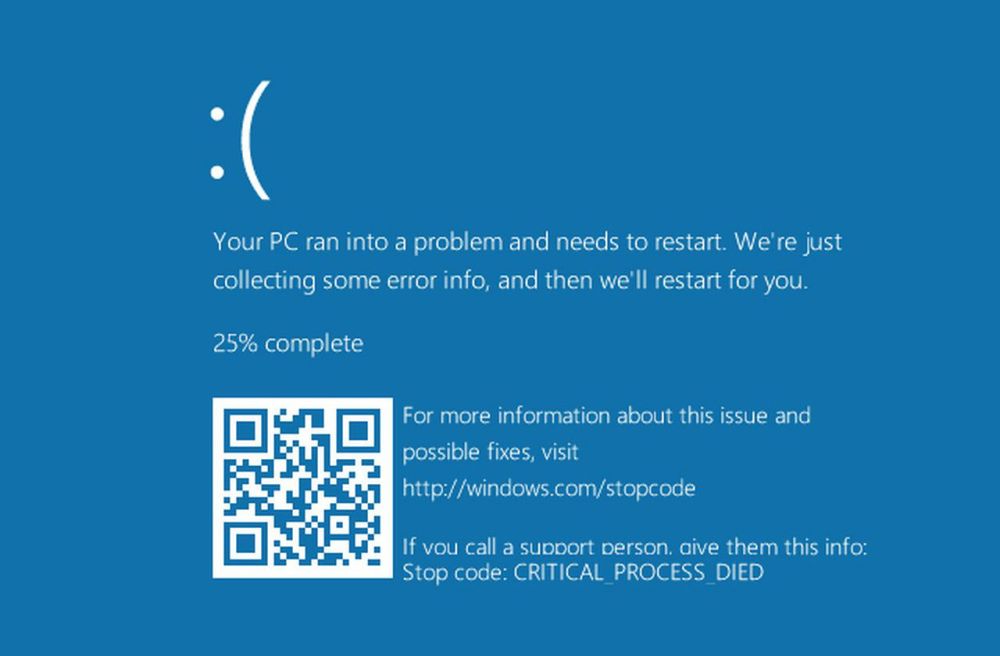

Reading Time : 2 minutesThe July 19, 2024 global tech outage underscored the vulnerabilities of modern digital infrastructure, impacting airlines, banks, hospitals, and media outlets worldwide. The disruption, caused by a faulty software update in Microsoft systems, grounded flights, delayed financial transactions, and disabled automated services, necessitating manual interventions in many sectors. The incident revealed the interconnected nature of global technology systems and their susceptibility to widespread disruptions from single points of failure. While cybersecurity firm CrowdStrike swiftly addressed the issue, the event highlighted the critical need for robust contingency plans and the importance of diversifying technological dependencies to mitigate future risks

Reading Time : 2 minutesThe nation’s largest banks are reporting a tale of two realities. While second-quarter earnings calls boasted impressive profits and revenue growth, a closer look reveals a potential storm brewing. Consumer credit data, from credit card losses to increased charge-offs, suggests some households are struggling to keep up with rising costs and interest rates.

Reading Time : 2 minutesInter-bank money transfers are a critical component of the global financial system, enabling banks to settle transactions and manage liquidity efficiently. However,

Read More