Embarking on a grand transition to electric vehicles, Hertz, a global car rental giant, stirred excitement in 2021 by ordering 100,000 EVs from Tesla, envisioning a sustainable future. However, recent developments have seen Hertz scaling back its ambitious plans, selling 20,000 EVs due to unforeseen challenges. As we delve into Hertz’s journey, we explore the broader implications for the electric vehicle industry, highlighting the complex interplay of demand, infrastructure, and market dynamics shaping the future of sustainable mobility.

In a bold move aimed at electrifying its fleet, Hertz, one of the world’s largest rental car companies, made headlines in 2021 by ordering a staggering 100,000 electric vehicles (EVs) from Tesla. The company envisioned a future where a quarter of its vast fleet, which comprises around 500,000 vehicles, would be electric by 2024. This ambitious shift towards sustainability was heavily promoted, featuring high-profile ads with Tom Brady and campaigns promising to “electrify major cities” such as New York, Atlanta, and Houston. However, Hertz recently surprised the industry by announcing the sale of 20,000 EVs, roughly a third of its electric fleet, citing the unexpectedly high costs of EV repairs and lower-than-anticipated demand as contributing factors. Hertz CEO Stephen Scherr admitted during a CNBC interview that the company might have been overly optimistic, saying, “We may have been ahead of ourselves.”

Hertz’s decision to scale back its EV fleet mirrors broader challenges facing the electric vehicle industry in the United States. While Q3 2023 saw a record 300,000 EV sales, the overall pace of adoption appears to be plateauing. Reports indicate that numerous EV dealers are grappling with excess inventory, and major players like GM and Honda recently abandoned a joint venture to develop EVs. Despite the setbacks, Elizabeth Sturcken, managing director of corporate partnerships at the Environmental Defense Fund, suggests that Hertz’s move shouldn’t be viewed as a sign of doom for the EV market. Sturcken attributes the decision to a “straightforward business decision,” pointing out that Tesla’s price cuts in 2023, driven by competition from Chinese EV makers, led to higher depreciation costs for Hertz than initially estimated, affecting the company’s valuation.

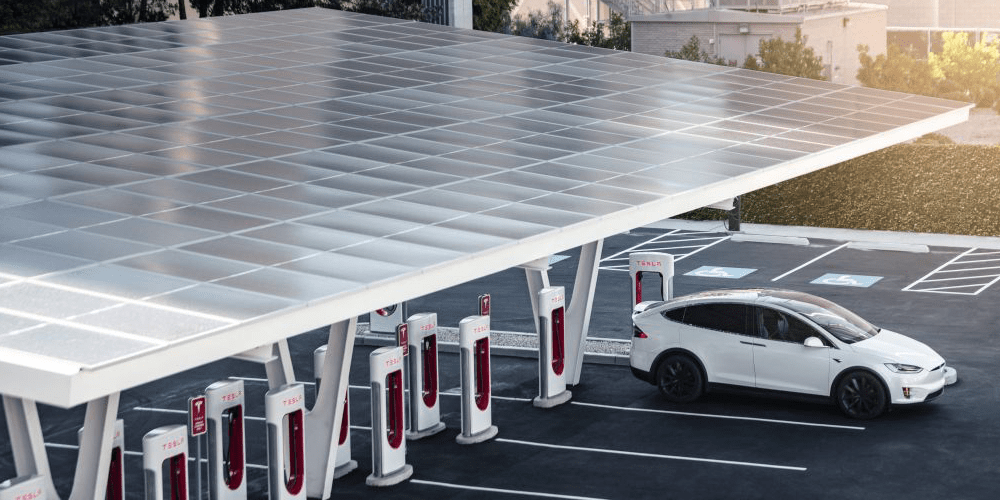

While Hertz’s retreat from its aggressive EV goals underscores the current challenges, it also highlights the underlying issues hindering the broader adoption of electric vehicles. Elizabeth Sturcken emphasizes the need for a more robust charging infrastructure to support the transition to electric rentals successfully. With charging stations in short supply across the US and a significant disparity in their distribution favoring higher-income cities, the country faces a considerable hurdle in achieving the Biden administration’s goal of having half of all vehicles sold be zero-emissions by 2030. Sturcken stresses the importance of aligning grid infrastructure and charging station deployment with the rapid pace of vehicle production to ensure a seamless EV experience for consumers, particularly in rental applications where unfamiliarity with charging locations poses additional challenges.