The cryptocurrency world is experiencing a seismic shift as Bitcoin recently shattered records, surpassing the $69,000 milestone. This surge has ignited a frenzy within the financial landscape, with US finance giants playing a pivotal role in propelling Bitcoin’s value to unprecedented heights. Behind this surge lies a complex interplay of institutional investments, regulatory shifts, and the intrinsic nature of the cryptocurrency market.

Flashback to Bitcoin’s Turbulent History : Born in 2009 under the pseudonym Satoshi Nakamoto, Bitcoin was conceived as a decentralized alternative to traditional currency systems, aiming to emancipate transactions from the control of central authorities. Its journey has been nothing short of a rollercoaster ride, marked by extreme highs and lows. After reaching dizzying heights in 2021, with a value surpassing $60,000, Bitcoin witnessed a dramatic plunge to $16,500 by 2022, leaving investors reeling.

Institutional Investments: Catalysts of Change. Fast forward to the present, and Bitcoin once again finds itself in the limelight. The recent surge, peaking at $69,200, can be largely attributed to major US investment firms such as Blackrock, Fidelity, and Grayscale pouring billions into the cryptocurrency market. The approval of spot Bitcoin Exchange-Traded Funds (ETFs) by US regulators in January 2024 paved the way for this influx, signaling a paradigm shift in the institutional acceptance of digital assets.

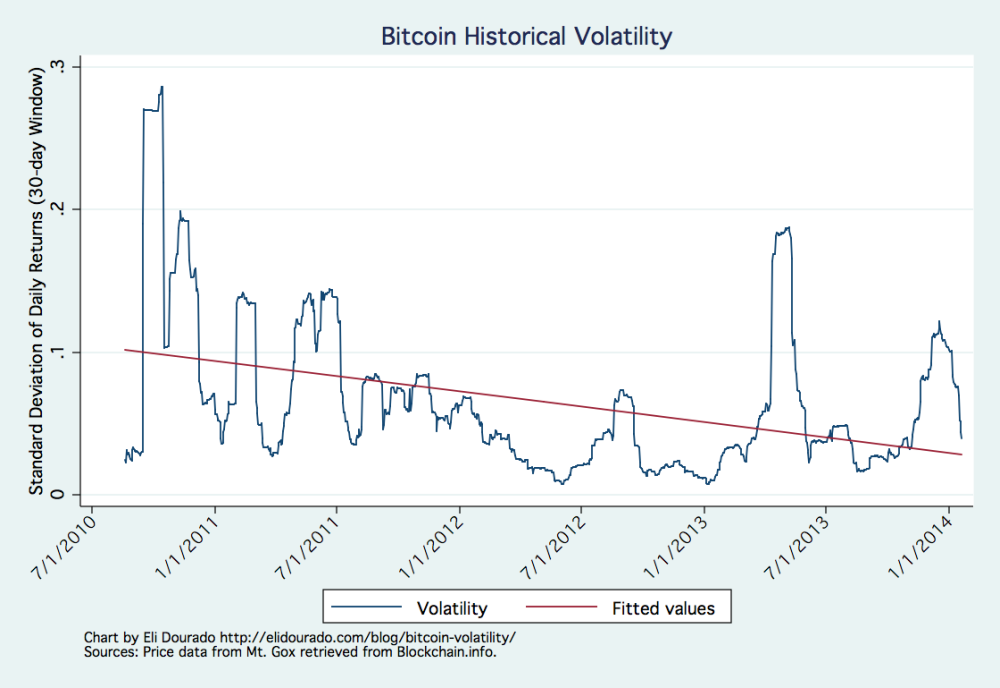

Global Ramifications and Cautionary Tales. The ripple effect of institutional investments in Bitcoin extends far beyond the financial realm. El Salvador’s President Nayib Bukele’s enthusiastic endorsement of the cryptocurrency, with a hefty investment of over $100 million from the nation’s coffers, underscores Bitcoin’s global impact. However, amid the excitement, cautionary voices emerge. Professor Carol Alexander of Sussex University warns of the inherent volatility of cryptocurrencies, advising investors to tread carefully amidst the frenzy. With the looming “halving” event scheduled for April adding another layer of uncertainty, the future trajectory of Bitcoin remains shrouded in speculation.

As the cryptocurrency world braces for what lies ahead, one thing is certain—Bitcoin’s journey is far from over. While the recent surge to $69,000 is cause for celebration among enthusiasts, the tumultuous history of the cryptocurrency market serves as a stark reminder of its unpredictability. As investors buckle up for the ride, the only certainty is the enduring allure of Bitcoin and the enduring quest for financial freedom it represents.