Today marks a pivotal moment for Reddit enthusiasts worldwide as the platform takes its first steps into the public market. With its initial public offering (IPO) under the ticker symbol RDDT on the New York Stock Exchange, Reddit is offering 22 million shares at $34 each, valuing the company at a significant $6.4 billion. However, this IPO diverges from the norm, with Reddit itself cautioning investors about potential volatility, spurred in part by skepticism from the very users who fuel its vibrant community.

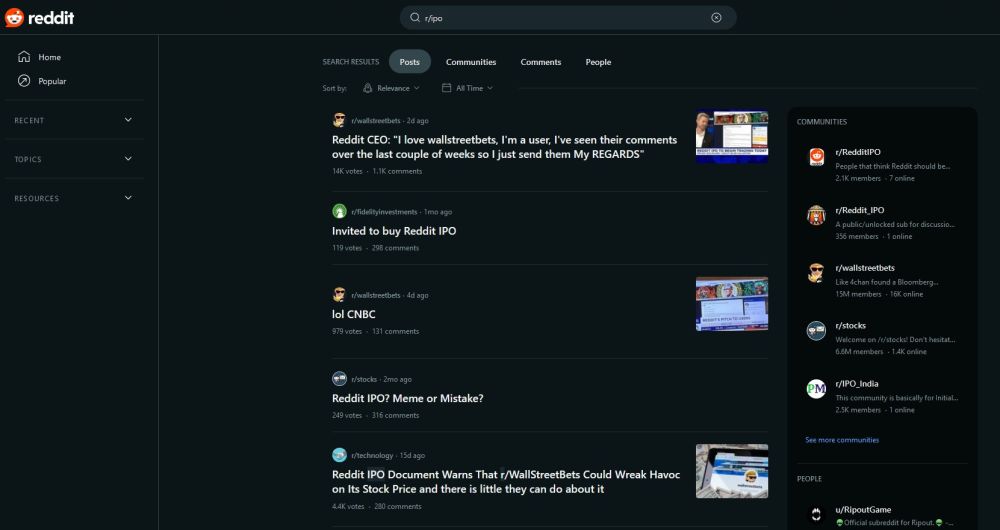

In a gesture toward its unique reliance on user-generated content, Reddit has reserved 1.76 million shares for select highly active users and volunteer community moderators based in the United States. Interestingly, many Reddit users are eschewing participation in the IPO altogether, instead discussing strategies to capitalize on its potential failure. The notorious r/wallstreetbets subreddit, boasting a membership of 15 million, is alive with speculation about shorting RDDT and anticipating a precipitous decline in its value.

Behind the scenes, Reddit grapples with internal tensions as it seeks to strike a balance between profitability and user satisfaction. CEO Steve Huffman’s efforts to monetize the platform, such as introducing fees for third-party developers, have met with resistance and community backlash. Now faced with the challenge of pleasing shareholders while retaining the loyalty of its user base, Reddit is at a critical juncture in its evolution.

As Reddit embarks on this new chapter, the delicate dance between financial success and community engagement will shape its trajectory. With controversial moves like its partnership with Google for data licensing, Reddit aims to diversify its revenue streams beyond traditional advertising. However, this strategy has attracted regulatory scrutiny, with the Federal Trade Commission launching an investigation into the agreement. The road ahead for Reddit is fraught with challenges, but its ability to navigate these complexities will determine its future in the ever-evolving landscape of social media and finance.