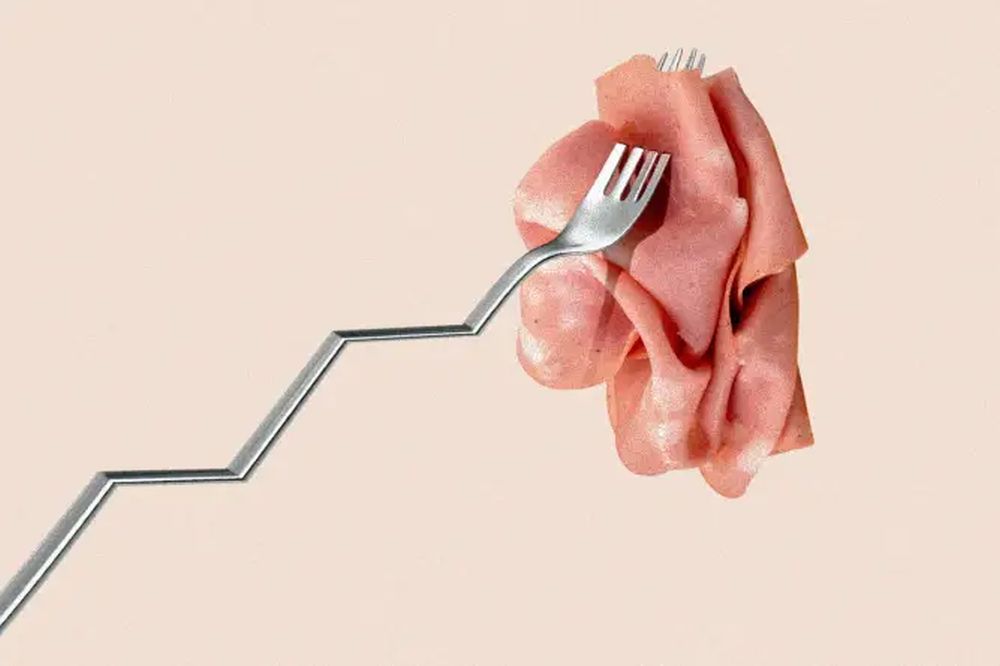

A financial revolution is underway as a new generation of billionaires’ children prepares to inherit staggering trillions within the next 20-30 years. Unveiling insights from a UBS report, this shift reveals that these heirs are now surpassing the wealth amassed by self-made billionaires. Discover the driving forces behind this change, from challenging market dynamics to the allure of consumer-centric enterprises, setting the stage for an unprecedented era of wealth transition.

The ever-evolving landscape of wealth distribution, a new elite group is poised to reshape the global economic landscape: the children of over 1,000 billionaires who are set to inherit trillions in the next two to three decades. The traditional narrative of self-made success is taking a backseat as big money changes hands in unprecedented ways. Unlike previous generations, the heirs of today’s billionaires are finding themselves pocketing more from family fortunes than from their individual entrepreneurial pursuits. This seismic shift in wealth dynamics is detailed in a recent UBS report, which sheds light on the financial trajectory of the world’s wealthiest individuals.

The UBS report, spanning the year until April 2023, reveals a noteworthy revelation: 53 heirs garnered an impressive $150.8 billion from deceased family members, outpacing the earnings of 84 newly-minted billionaires who collectively made $140.7 billion during the same period. This marks a significant departure from the norm, where billionaires typically accrued their wealth through the success of their own startups. UBS, having tracked this trend for nine years among its top clients, representing half of the world’s billionaires, points to factors such as high interest rates, a sluggish IPO scene, and global economic challenges as catalysts for this paradigm shift. Meanwhile, affluent families managing consumer-focused enterprises, exemplified by the likes of LVMH’s Bernard Arnault and his kin, are capitalizing on the post-pandemic, treat-yourself mentality.

As we peer into the future, UBS predicts a substantial transfer of wealth as 1,000 billionaires pass away in the next two to three decades, leaving their offspring with a staggering $5.2 trillion. However, this impending inheritance comes with a twist. The youngest 0.00004% of this exclusive group are demonstrating a unique approach to wealth management. Rather than conforming to traditional philanthropy, they are more concerned about long-term risks and are channeling their financial resources into impact investing. This avant-garde strategy reflects a departure from the old-school charity model, showcasing a growing awareness among the billionaire heirs to contribute meaningfully to societal and environmental issues in their pursuit of wealth stewardship.

The financial landscape is witnessing a paradigm shift with the impending wealth transfer to billionaires’ descendants. This evolution, propelled by factors like market complexities and consumer-driven successes, is redefining the narrative of wealth accumulation. As these affluent heirs steer toward impact investing over traditional philanthropy, the future unfolds with unprecedented challenges and opportunities, shaping the destiny of the world’s next elite class.